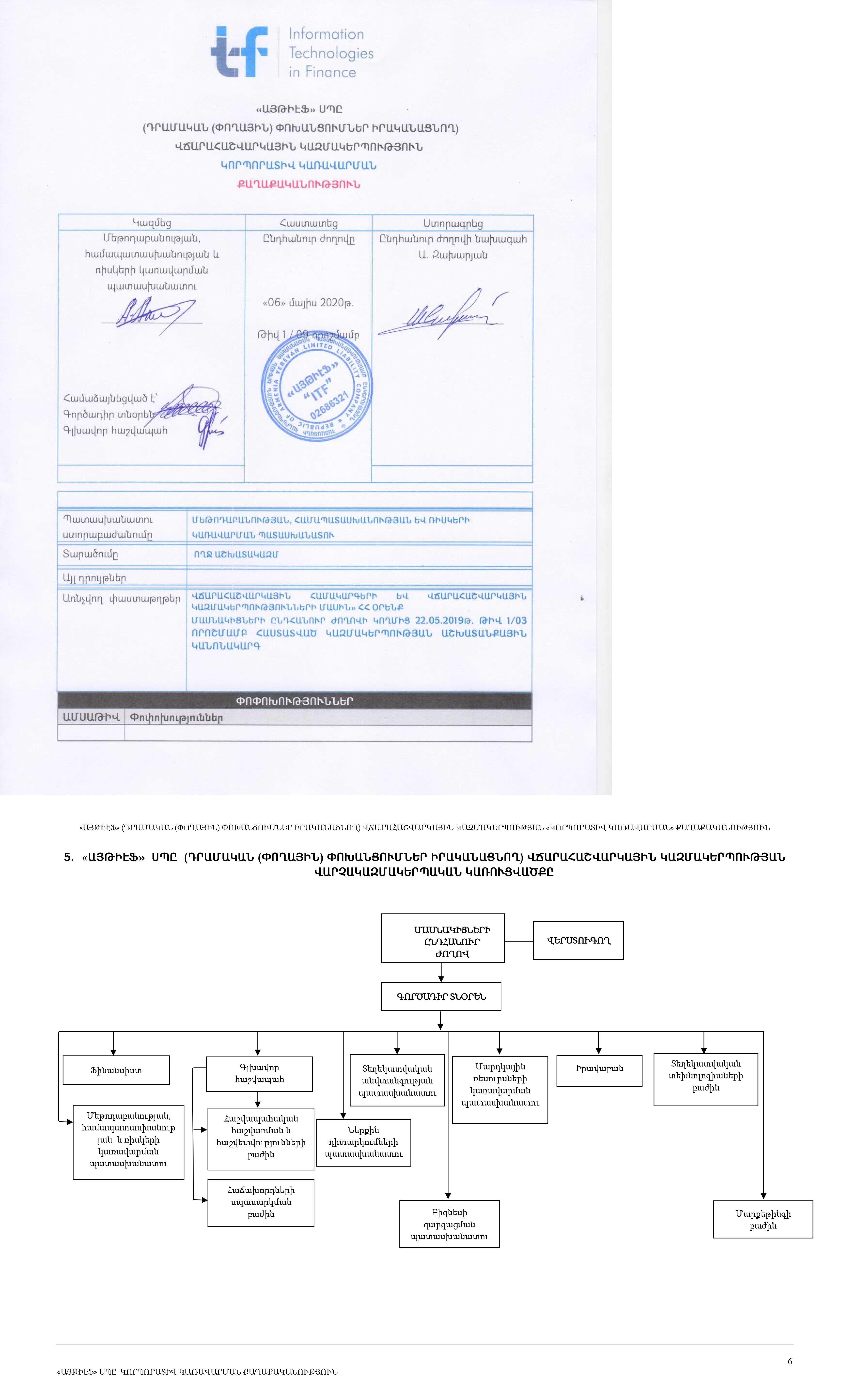

INTERNAL ADMINISTRATIVE ORGANIZATIONAL STRUCTURE OF THE

"ITF LLC" PAYMENT SERVICE ORGANIZATION (REALIZED REMMITANCE (MONEY) TRANSFER)

Dear visitor, You can read the organizational structure approved by the General Assembly of the organization:

Dear visitor, the list of main laws and normative legal acts, which regulate the provision of settlement services by the organization, is published below.

Laws:

- Civil Code of the Republic of Armenia,

- RA law “On Payment and Settlement Systems and Payment and Settlement Organizations”

- RA law “On Funds Transfer by Payment Order”

- RA law “On the Central bank of the Republic of Armenia”

- RA law “On Bank Secrecy”

- RA law “On Combating Money Laundering and Terrorism Financing”

- RA law “On Accounting”

- RA law “On Cash Collection”

- RA law “On Financial System Mediator”

- RA Law "On Currency Regulation and Currency Control".

Sub-legislative normative legal acts approved by the Board of the Central Bank of RA:

- Regulation “On Minimum Requirements to Reporting Entities in the Field of Preventing Money Laundering and Terrorism Financing”

- Rules “For Registration of Reporting Entities under the Republic of Armenia Law on Combatting Money Laundering and Terrorism Financing”

- Guidance “On criteria of high risk and indicators of suspicious activity in realtion to money laundering and terrorism financing”

- List “Of Off-Shore Territories”

- Regulation 8/03 “On Information Publication by Banks, Credit Organizations, Insurance Companies, Insurance Brokers, Investment Companies, Central Depository and Payment and Settlement Organizations Implementing Money Remittances”

- Regulation 8/04 “On Minimum Conditions and Principles for Internal Rules, Regulating the Procedure of Examination of Complaints/Claims of Customers”

- Regulation 8/05 “Rules of Business Conduct of Financial Institutions”

- Regulation 8/07 "Minimum Requirements and Principles for the Internal Process of Registration, Storage and Registration of Complaints to Financial System Participants"

- Regulation 9 “On Operations with Cash in Banks Functioning on the Territory of the Republic of Armenia”

- Regulation 17/01 “Licensing of Payment and Settlement Organizations, Registration of Branch Offices; Qualification of Managers of Payment and Settlement Organizations, Requirements to Payment and Settlement Organizations for Technical, Software and Safety Adequacy at their Premises; Register of Activity License to Payment and Settlement Organizations; Information Contained in the Register”

- Regulation 17/02 “Regulation of Activities of Payment and Settlement organizations, Prudential Standards of Payment and Settlement Organizations, Procedure of their Calculation”

- Regulation 17/03 “Statements of Payment and Settlement Organizations: Submission and Publication”

- Regulation 17/09 "Cash Operations in Payment and Settlement Organizations operating in the Territory of the Republic of Armenia"

- Regulation 18 “On Granting Permits for Creating and Operating Armenian Payment and Settlement Systems

- Regulation 19 “Granting Permission to Participate in Foreign Payment and Settlement Systems; the List of Changes to Foreign PSS Operational Rules and Documents reportable to the Central Bank of Armenia; Foreign PSS Criteria; and Running of Registry”

- The Resolution No 39-N of the Board of the Central Bank of RA dated 31.01. 2006 “On Approving the Procedure of Issuance, Servicing and Distribution of Payment Cards, Operations Implemented through Payment cards”

- The Resolution No 238-N of the Board of the Central Bank of RA dated 24.05. 2005 “On Approving the Procedure of Issuance, Honoring, and Circulation of Checks within the territory of the Republic of Armenia”

- The Resolution No 96 of the Board of the Central Bank of RA dated 25.04. 2000 “On Approving the Maximum Time Periods for Implementation of Transfers of Funds by Payment Orders”

- The order of transfer of funds in the Republic of Armenia by direct debiting

- Guidance on "Money transfers through payment order"

- The order of “Making transfers using regular payment orders in the Republic of Armenia"

- The procedure, standard forms of published financial reports of payment and settlement organizations and the procedure for filling them out"

- The procedure "On the establishment of minimum requirements for information security" ,

- The decision "minimum details of documents used in making payment and settlement transactions and the rules for filling them out"

- The procedure and conditions for obtaining data from the information system for accounting administrative fines and fines of the Traffic Police of the Republic of Armenia and mandatory verification of these data for making payments"

- Regulation 8/07 "minimum conditions and principles applicable to the internal accounting process, storage and registration of complaints against participants in the financial system"

The aforementioned laws and regulations can be found on www.arlis.am and www. cba.am․

GENERAL RULES OF BUSINESS CONDUCT AND ETHICS

Fair treatment of partners and customers in the organization is defined as the basic rule of business conduct and ethics and should be taken into account in the decision making process in the organization. The organization should ensure transparency in its relationships with customers and partners, as well as a sufficient level of protection of customer interests.

The business process of payment and settlement services provided by the organization includes:

- a detailed description of each service provided,

- terms of service and necessary documents,

- tariffs for services (including commissions and other fees, their list), terms and conditions for changing them,

- List of documents (information) required from customers and partners to provide services,

- all conditions restricting access to the service provided by the organization to the customer;

- standards for rejecting transactions (refusing to provide services) by the entity,

- the process of correcting errors made during service,

- the process of interrupting the service provided by the organization to both the specific customer and the organization in general;

- measures to identify and exclude possible conflicts of interest in customer service.

- The organization should ensure high responsibility for the conduct of business and the protection of clients' interests, and the employees of the organization should be guided by the requirements of high professionalism, conduct and ethics.

- In terms of business conduct and customer protection, the organization provides fair treatment to customers, which at least assumes:

- consideration of the needs and interests of partners and clients in the development and delivery of payment and settlement services;

- Avoiding services that do not fit the needs of the customer,

- Ensuring high quality of advice given to the customer during payment and settlement service provision,

- fair and timely examination of customer complaints, applications and / or claims;

- Providing the customer with clear, reliable, timely and relevant customer information while providing payment and settlement services;

- maintaining confidential information about partners and customers, as well as justifying reasonable customer expectations;

- payment and settlement services (under contracts with more / less favorable terms) excluding general terms and conditions provided by partners and customers exclusively if relevant standards are met.

- The customer can find out the details and working hours of the services provided by the relevant staff of the organization's head office / branches, as well as the organization's website, information bulletins, etc. Information provided to the Client is simple and accessible and does not contain confusing words or phrases. The information shall be provided in at least Armenian, unless a different language is selected by agreement between the client and the company.

- When providing payment and settlement services, the Customer shall provide the necessary information and documents required for carrying out the transaction required for the provision of the particular service. The list of required documents is provided on the organization's website and information bulletins at the customer service desk. The customer can be informed of the amount of payment for his utility and other services upon request (even when no payment is made).

- When performing payment and settlement operations, the customer shall be provided with the documents certifying payment established by the RA legislation and the Central Bank of the Republic of Armenia Central Bank approved documents, “Minimum Requirements of Payment and Settlement Documents Implemented by Rules”.

- Employees of the organization are obliged to follow the following rules when serving customers:

- Employees must always be polite, respectful, polite and provide excellent customer service, as well as be willing to assist any Customer.

- Any client of the organization can get the whole list of payment and settlement services offered by the organization in the head office / branches of the organization;

- Payment and settlement services are provided by the customer's staff as quickly and as qualitatively as possible;

- During the provision of payment and settlement services, the Customer shall not address the Customer with the following phrases: "This is your problem", "This is not my business", "I do not know", "I cannot help you" and so on.

SIGNIFICANT PARTICIPANTS

According to the RA Law on Payment and Settlement Systems, the Laws regulating the activity of the RA banking system and the normative legal acts approved by the Central Bank of RA, the Organization's direct participants are:

First Name, Last Name

|

Date of entry in the Unified Register of Legal Entities of the Ministry of Justice of the Republic of Armenia

|

Stocks

|

Stocks in AMD

|

Zakharyan Razmik Artur

|

01.11.2018

|

30%

|

42,172,054.50

|

Zakharyan Artur Razmik

|

05.04.2019

|

60%

|

84,344,109.00

|

Zakharyan Eduard Razmik |

05.04.2019 |

10% |

14,057,351.50 |

Total |

|

100% |

140,573,515.00 |

100% of the registered and fully paid authorized capital of the Organization (140,573,515.00 drams) belongs to the Zakharyan family, which is the ultimate controller of the organization.

According to the legislation of the Republic of Armenia, the organization has no indirect significant participants.

STATUTE OF THE ORGANIZATION

You can get acquainted with the charter of "ITF" LLC with the links below.

On October 11, 2019, the Central Bank of Armenia issued the license #22 to ITF LLC as a payment service organization realized remmitance (money) transfer.

"ITF" LLC payment service organization realized remmitance (money) transfer received ISO 27001: 2013 international certificate of information security management system, approved by the Board of the Central Bank of the RA on July 9, 2013. Based on the requirements of the procedure "On Setting Minimum Requirements for Information Security" approved by Resolution No. 173-N.

"ITF" LLC was registered by the State Register of Legal Entities of RA on 01.11.2018, registration number 286.110.1043870

On October 11, 2019, the Central Bank of Armenia issued the license #22 to ITF LLC as a payment service organization realized remmitance (money) transfer.

Address: 15 Arshakunyats ave., Yerevan 0023, Armenia

Business address: 15 Arshakunyats ave., Yerevan 0023, Armenia

Business address: 15 Arshakunyats ave., Yerevan 0023, Armenia

Tel: +374 10 540 517, +374 12 20 40 50

E-mail: hello@itfllc.am, info@itfllc.am

Working days: Monday to Friday

Customer service hours: 09:30- 16:45.

The mission of the organization is to gain a reputation for providing comprehensive, affordable, convenient and up-to-date payment services to all segments of society and "To be a Trusted Partner and Deliver Integrated Payment and Settlement Services to Customers".

The organization’s goal is to expand its position in the Armenian payment and settlement services market by expanding the list and geography of customer service, as well as to strengthen its position in the RA payment and settlement services market with the introduction of information technologies.

The values of the organization are the development of payment and settlement services market based on full mutual trust, transparency, mutual benefit and business reputation. This relationship should be largely conditioned by the quality and individual approach of the payment and settlement services offered by the organization while maintaining a manageable and acceptable level of risk.

When providing payment and settlement services, be guided by the norms of business ethics, apply an effective tariff policy, ensure a high quality of customer service and gain the reputation of a reliable partner.

When providing payment and settlement services, the organization must comply with the requirements of the legislation of the Republic of Armenia and the regulatory legal acts of the Central Bank of the RA.